Recommended Suggestions For Deciding On Britannia Gold Bars

Wiki Article

What Should I Consider Before Purchasing Gold In The Czech Republic?

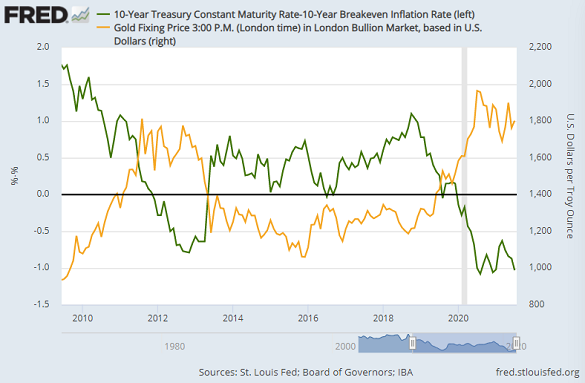

Tax implications: Be aware of the tax implications when buying and selling gold in the Czech Republic. Tax laws can differ for investment gold, and can affect your income. Market Conditions- Monitor the market's trends, which includes changes in the price of gold. This will allow you to make informed choices about the best time to invest.

The authenticity of the Gold Bullion as well as Coins- Ensure to check that any gold coins that you purchase are authenticated and come with all necessary documentation.

Determine what you wish to accomplish with your investment portfolio. If you are planning to buy gold, consider whether you are doing it to protect your wealth over the long term or portfolio diversification, an the hedge against inflation, or to mitigate uncertainty in the economy.

Consultation and research- seek advice from financial advisors or experts in investment in precious metals. Conduct extensive research and learn on the gold market in order for informed investment choices.

While gold can be a great investment, it's essential to study your options and be aware of what you'd like from the investment, and also the risk you're willing to risk. Have a look at the top rated buy Gold Britannia for more examples including buying gold bars, 24k gold coin, gold exchange traded funds, 2000 sacagawea, 5 dollar gold coin, 50 pesos gold coin, apmex gold coins, spanish gold coins, gold eagle coin, 1975 gold penny and more.

How Can I Make Sure That I'm Buying Gold Bullion Or Coins Of High Quality In Czech Republic?

The verification of the authenticity and documentation of bullion or gold coins in the Czech Republic involves several steps to confirm their legitimacy.-

Verify serial numbers and bar Codes. Some gold products include barcodes or serial codes which can be checked against manufacturers' records or databases to provide authentication verification. Minted or government Coins - Coins produced or issued by institutions recognized by the government or recognized by it are often authentic due to their quality control and their controlled production.

Research and become knowledgeable about the distinctive features and characteristics of gold. To be able to identify copyright gold, or fakes know the most popular indicators.

Transaction Records – Keep all documents and receipts relating to the purchase of gold to be used for future verification and reference.

Be wary and obtain confirmation if you think suspicious about something or appears too good to be authentically be true. gold.

The verification of the authenticity and quality of gold bullion coinage requires a mixture of due diligence, and relying on reputable sources, and acquiring proper documentation. Check out the recommended gold price Britannia hints for site advice including 1 oz gold, ancient coin, sell gold and silver near me, 1972 gold dollar, george washington gold dollar coin, 1 oz gold coin, price of 1 oz of gold, gld shares, purchase physical gold, 1 ounce of silver and more.

What Is A Low Price Spread And How Is It A Markup Of The Price Of Gold On The Stock Exchange?

In the context of trading gold low mark-ups and low price spread refer to the costs associated with buying or selling gold in relation to the market value. The terms are used to describe the amount of extra amount you might have to pay (markup), or the difference in price between the buying and selling price (spread), beyond the price of gold that is market-value. Low Mark-up- This signifies a minimal additional cost or a premium over the gold market price that dealers charge. A low markup is when the price you are charged for buying gold, is just a little or barely over the market price at which it is currently.

Low Price Spread - The spread can be described as the gap between gold's buying (bid) price and the selling (ask). A low price difference indicates an even wider spread between these two prices.

What Is The Difference In Price And Margins Among Different Dealers Of Gold?

Negotiability. Some dealers are more flexible in negotiating spreads and markups. Geographical location- Spreads and mark-ups may differ depending on the regional conditions such as local regulations, regional laws, and taxes. Dealers in areas where taxes and regulatory costs are higher may pass these expenses on to their customers through increased the markups.

Types of Products and Availability: Markups and spreads can vary based on product type (coins/bars/collectibles) as well as availability. Because of their collectibility or rarity rare or collectible goods might have higher mark-ups.

Market Conditions: In times that are more volatile and also when there is a high demand (or scarcity) dealers might increase their spreads in order to safeguard themselves from losses and reduce risks.

Because of these reasons the gold buyers must conduct extensive analysis and compare prices with multiple dealers. They should also look at other aspects aside from margins and markups like reliability, customer service and reputation when selecting the right dealer. Comparing prices and receiving estimates from multiple sources will allow you to find the best price on gold. See the recommended Britannia gold bullion advice for more advice including american gold eagle, gold ira, best gold ira companies, 20 dollar gold coin, gold silver coins, gold quarter dollar, best place to purchase gold, find bullion prices, gold coin values, $20 gold piece and more.